This is the website of Abulsme Noibatno Itramne (also known as Sam Minter).

Posts here are rare these days. For current stuff, follow me on Mastodon

|

Ultimate Battle: The Snuggie vs. Slanket vs. Freedom Blanket vs. Blankoat

(Jason Chen, Gizmodo, 30 Mar 2009)

The Slanket, the Snuggie, the Freedom Blanket or the supremely expensive and extravagant Blankoat? This is the most important question of the millennium. You’re about to know the answer.

Those who haven’t seen the Snuggie ad or one of its many parodies and aren’t aware of the blanket-with-sleeves phenomenon get no sympathy from us. Unless, you’ve just awoken from an eight-month coma, in which case: Welcome back! To recap, the Snuggie is the most famous and widely marketed of the many blanket-with-sleeves. The Freedom Blanket originated the idea, the Slanket followed up, and recently, the Blankoat decided to take it into a ridiculous dimension.

But which is the best for you? We tried each of them the way they were meant to be worn: on the sofa, lying down, with one fist buried in a bag of Doritos and the other cradling a bottle of beer. We gained thirty-five pounds, but it was so worth it.

And for those of you who think that the whole blanket-with-sleeves product could just as easily be accomplished with a robe worn backwards? We tested that too.

Of course you’ll have to click through to read the results of the test… :-)

Obama Denies Bailout Funds For Automakers

(Philip Elliott, AP on Huffington Post, 30 Mar 2009)

The White House says neither General Motors nor Chrysler submitted acceptable plans to receive more bailout money, setting the stage for a crisis in Detroit that would dramatically reshape the nation’s auto industry.

President Barack Obama and his top advisers have determined that neither company is viable and that taxpayers will not spend untold billions more to keep the pair of automakers open forever. In a last-ditch effort, the administration gave each company a brief deadline to try one last time to convince Washington it is worth saving, said senior administration officials who spoke on the condition of anonymity to more bluntly discuss the decision.

Obama was set to make the announcement at 11 a.m. Monday in the White House’s foyer.

Buh Bye!

SlingPlayer for iPhone submitted to app store

(Mel Martin, TUAW, 26 Mar 2009)

Sling has announced that SlingPlayer for iPhone has been submitted to the app store for approval. The company had previously said the app would be submitted this quarter, and it’s in just under the wire.

Sling already has versions for Blackberry, Windows Mobile, Symbian and Palm smart phones. No one can predict when, or if, Apple will approve the software, but there will be iPhone owners with pitchforks and torches outside Apple headquarters if the much sought-after app does not appear soon.

Sam and Ivan Talk about: Sam and Ivan Talk about:

- Facebook Connect

- Email Forwards

- iLife 09

- Sam’s Slowness

- Bailouts, Breakups and Failures

- Disclosure and Regulation

- Hiding Risk

- AIG Bonuses

- Cuban Bous

1-Click Subscribe in iTunes 1-Click Subscribe in iTunes

View in iTunes View in iTunes

Podcast XML Feed Podcast XML Feed

Note: For those using the “View in iTunes” link, it often takes iTunes quite a few hours to show a new episode after the episode is posted here. So if you are looking for the podcast very soon after I post this, use one of the other methods to find the new episode. For those who are subscribed, your Podcast software should pick up the new episode next time it checks for new episodes on its own, or you can always force a refresh. For those using the XML feed directly, the new episode is now there.

That the total amount of all these stupid bonuses is a tiny tiny fraction of the TRILLIONS we are spending overall in bailouts, stimulus, and crazy stuff the Fed is doing. Even wasting 5 minutes on this is a huge distraction from paying attention to the parts of this that actually matter more and which are REALLY wasting the public’s money.

To reiterate… I say just let everything die.

A good hard long recession will clear everything out to make room for later generations.

Brandy points out that my old email archives (paper archives from the early 90’s from before I had enough hard drive space to store everything) will not fit in the car we would have to live in.

So be it.

For the record, although I’m sure Ivan and I will talk about it on the next show… I think the AIG bonuses are crazy. But I think the proposed retroactive taxes to take them away from the people who got them are completely and totally wrong and misguided and a horrible horrible precedent. We want a government that feels free to decide after the fact that it doesn’t like that you made the money you made, and then change the rules so that they can take it from you… after you’ve got the money (and quite possibly after you have spent it, not knowing it would be taxed)? Really? We want that? Really?

These bonuses were written into contracts that AIG made. They were probably contracts AIG should not have made. But they were already done by the time the bailout happened. They were obligations, just like the other debt obligations AIG had. Of course AIG was going to pay its debts with the bailout money. That is what the bailout was for after all. Duh.

And no, we shouldn’t have put strings on the bailout saying that AIG should pay some debts but not others. If we really felt that way, we should not do a bailout at all. Let the damn thing go out of business, then if there are creditors we think deserve it more than others, bail THEM out.

All and all, with every turn of every screw in this whole saga, I’m more and more convinced that the “right” thing to do, going back all the way to last fall, is to not have bailed out a damn thing. Not one company, not one industry. Not the financials, not the autos, not nothing.

Would we have a worse recession right now if we had? Probably. I won’t try to argue against the folks that say these bailouts were necessary to prevent that from happening. I’ve always had severe reservations though.

And at this point I’m thinking that perhaps an extremely severe recession where most of the companies in most of these industries go completely out of business… taking with them all of the other companies… and yes regular people… who depended on them… is really the only way to get the bad blood out of the system. To completely and totally kill (for at least a generation or two, these things always come back) the idea that the bad practices that resulted in the mess are things NOT TO DO. Right now, I don’t see that lesson REALLY being learned. People are just waiting for the tide to turn and then they will go right back to where things were.

We need to get back to the point where if you are going to try something, you really do shoulder almost all of the risk for it yourself, rather than trying to bury the risk in layers of insurance products designed to make the risky not risky. Hey, guess what, things are still risky. You’re just moving the risk around and making it harder to see. It does not go away. And maybe insurance makes sense when it is against things which are actuarially highly predictable like death and disease and fender benders… but there should not be insurance against bad business decisions. It just distorts the whole incentive model and encourages people to take on very risky endeavors that are probably best left on the table.

How about a little caution and prudence instead? Sure, you don’t get as big an upside, but so what.

Anyway, I say bring on the damn depression. Let everything fail. Salt the earth. Perhaps there will be horrible pain for a generation. But what comes after that will be stronger because of it. Trying to prop this crap up MAY be helping things in the short term, but in the long term, it is just propping up businesses and business practices that deserve to fail. Let them die.

DIE DIE DIE.

Sam and Ivan talk about: Sam and Ivan talk about:

- Plates and Such

- Ivan is Busy

- Companies in Panic

- AIG Fun

- Feedback

- Software and Shuffles

1-Click Subscribe in iTunes 1-Click Subscribe in iTunes

View in iTunes View in iTunes

Podcast XML Feed Podcast XML Feed

Note: For those using the “View in iTunes” link, it often takes iTunes quite a few hours to show a new episode after the episode is posted here. So if you are looking for the podcast very soon after I post this, use one of the other methods to find the new episode. For those who are subscribed, your Podcast software should pick up the new episode next time it checks for new episodes on its own, or you can always force a refresh. For those using the XML feed directly, the new episode is now there.

Yeah, yeah, sorry. Still no podcast. I’m a good deal of the way done, but I must go to work now. Probably should have even left a little earlier. My bad. Tonight for sure.

I hate it when I release this late in the week, but it hasn’t been a good week in terms of me being able to get things done at home after work. I’ve either not been feeling great or I’ve had other stuff to do each evening.

Oh well. Tonight.

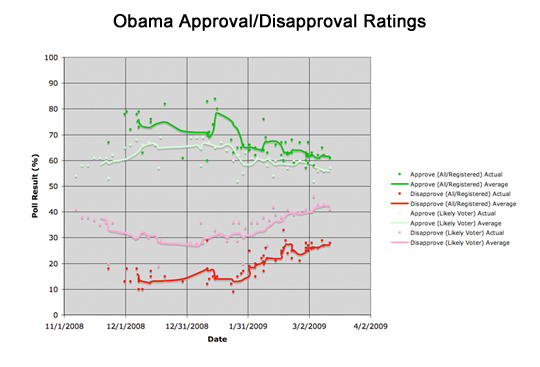

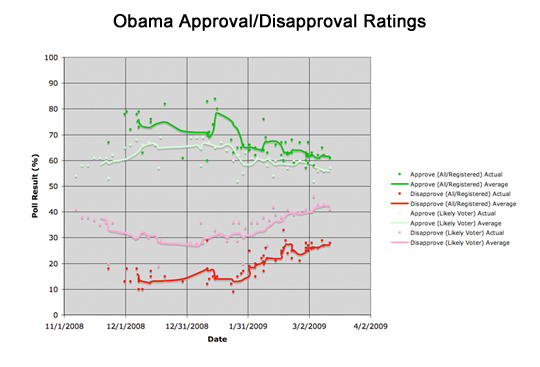

Chris Weigant once again uses some graphs I made for him, and some quotes from me, in an article on his site Wednesday.

A Surprise In Obama’s Poll Numbers

(Chris Weigant, 18 Mar 2009)

It really is a bit early to focus on President Obama’s approval ratings in the polls, I know. But, rather than looking at the overall picture of how he’s doing, I have been noticing something interesting which I don’t believe others have picked up on — Obama’s numbers dramatically improve depending on the sample used by the pollsters. When “likely voters” (LV) are polled, the numbers they give are different from when either “registered voters” (RV) or “all adults” (A) are polled. Obama’s LV approval rating is about five points lower than the RV/A numbers. The difference is more pronounced in the disapproval ratings, where LV numbers are fully ten points higher than RV/A numbers.

(Also cross posted at Huffington Post)

Chris draws some tentative conclusions from this about there (at least potentially) being a reservoir of extra strong support for Obama among the folks who are in the “All” or “Registered Voter” samples but who are not in the “Likely Voter” samples… perhaps tied to people who were not traditional voters who were “energized” by the Obama campaign and are retaining their excitement.

Maybe. But as Chris quotes me in his article, I have my doubts and think it is highly likely that there is a much more pedestrian explanation. The quote of mine Chris gives does hit on the crux of this, but for completeness to get my own thoughts on this out there, let me quote here a bit more of my comments to Chris which he excerpted. (I’ve made some minor edits to fix some wording issues with the original, and to remove other comments not directly relevant.)

Date: 15 March 2009 04:10:58 GMT

I can’t do fancy loess regression like Pollster does. The lines are simple “last five poll” averages. But for these purposes that is probably fine.

My gut feel here is that these differences are actually somewhat tied to how undecideds or non-responders are taken into account. If you take my “average” lines for approve and disapprove and sum them at each point, for All/Registered you will see that the sum varies from 79.2% to 92.4% with an average of 87.5%. Meanwhile, for likely voter the sum varies from 88.6% to 99.0% with an average of 95.1%.

This means that the “all” group has a much higher undecided rate… which could either be a real effect or just that the likely voter polls push harder for an answer. It actually makes sense though that people who are less likely to vote are more undecided though, so lets assume it is a real effect.

What would more undecided people result in? Hmmm… well at first you’d think that it would lower BOTH the approve and disapprove numbers. But what we are seeing here is lower disapprove, but HIGHER approve. So what does this get you? Maybe there is a real effect here… something along the lines of the less-likely voters being more willing to give the benefit of the doubt and give an “Approves” rating and less likely to take a leap and say “Disapprove”.

I think this also makes sense for the less-likely voter. Less likely voters are also most likely less in tune and in touch with what is going on… generally less informed. So they are giving the benefit of the doubt on approval, and less likely to disapprove, because they don’t feel they know enough to pass a negative judgement.

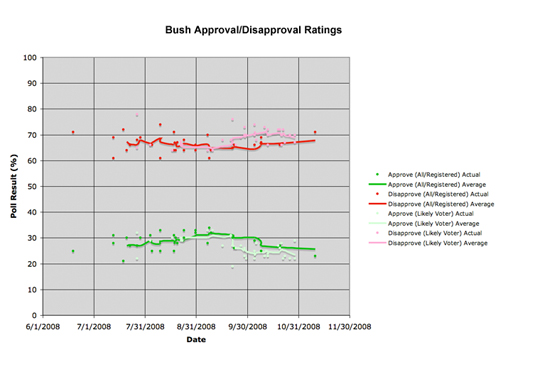

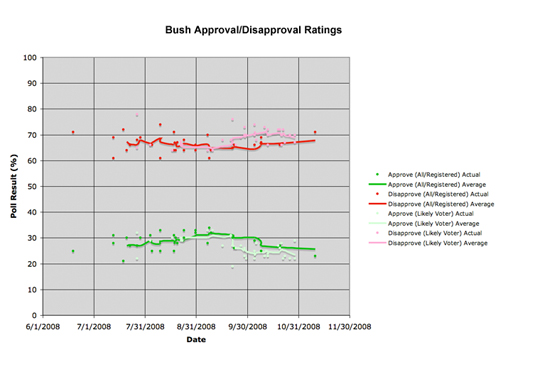

I haven’t tried this, but I’m guessing if you broke the polls up in a similar way for the last few years of the Bush administration, you’d see the same pattern… with the broader sample generally being less negative (more likely to approve, less likely to disapprove). This just seems like the natural tendency you would get from less informed people, which is who you are adding when you move from Likely Voters to the broader sample.

That is my guess anyway.

But you are right, the differences are quite clear between these groups.

Date: 15 March 2009 04:52:57 GMT

OK, before July or so, the polls were not identified as likely/registered/all, so there was no way to differentiate. So this only shows those polls that were in fact broken up that way.

So yes, with Bush in his last few months we do see the same pattern… the wider sample is more likely to be positive, and less likely to be negative. The differences are MUCH smaller though, and at certain points (back in August and September) the lines are almost indistinguishable. But I still think this does hold with the general principal that the people who are less likely to be engaged (and therefore not likely voters) are more likely to approve “by default” and less likely to give a negative (disapprove) rating. Basically, if you don’t pay attention to what is going on, you give the benefit of the doubt.

If one does the same exercise as I did last time looking at the sum of approve and disapprove, we see that the number of “undecideds” is almost identical between the two groups (rather than being larger in the wider sample). This actually makes some sense too… after 8 years, almost everybody felt they had enough information to make a judgement about Bush, and the percentage of people who felt like they didn’t know enough and therefore did that benefit of the doubt thing was much smaller.

At least, I think that explanation is a good tentative explanation of both the Bush and Obama results.

Date: 18 March 2009 06:49:08 GMT

I hypothesized that what is going on here is simply that non-likely voters… which are likely to also be people who are less informed about what is going on, and generally pay a little less attention to what is going on, are just more willing to “give the benefit of the doubt” and therefore are more likely to give a positive rating AND less likely to give a negative rating… they just generally are a little bit more positive than the people who actually pay attention.

And the Bush number seem to also follow this pattern… with the addition that after 8 years, even the people who pay less attention had a lot more information and were more likely to have an opinion, so the degree to which they are more positive than the likely voters is a lot less.

Now, all of the above is just a hypothesis. To actually test it, you’d actually have to run some polls specifically designed to investigate this and to control for other effects. This is just my guess as to a plausible interpretation of the data.

…

I would hesitate to attribute this as actual SUPPORT of Obama. The non-likely voters are almost by definition people who are less politically engaged. So what “approval” means is a softer concept in this group. It is kind of like asking me, as someone who doesn’t follow sports at all, if I approve of how my local sports team is doing. I honestly have no idea how they are doing. So, while perhaps I would pick a neutral position if I’m given the choice, I’m still pretty likely to say I approve of how they are doing… the default position is to assume they are doing OK… it is the position that causes the least friction. If I said I disapprove, I feel like I need to have reasons… maybe even good reasons… for saying I disapprove. But if I really don’t pay much attention, and don’t have a strong opinion, I’ll be reluctant to pass the negative judgement.

…

In the end, my thoughts about the undecideds may have been tangential. Basically, if there was no difference in behavior on these polls between Likely voters and non-Likely voters, other than there being a greater undecided rate among non-likely voters, one would expect that BOTH approve and disapprove would be LESS in the non-likely voter group… but that is NOT what you see. Disapprove is less as expected, but approve is unexpectedly higher. This indicates that there is indeed a behavioral difference other than just a higher tendency to be undecided. The bit about the “benefit of the doubt” is my stab at explaining that behavioral difference.

And that is that. :-)

Yes, I know, I should have released the podcast by now. I’ve had a cold so once I’ve gotten home from work I haven’t been very productive, plus my computer has been nicely slow. And well, OK, I just didn’t do it yet. I’ll probably put it together tonight and release in the morning. We’ll see.

|

|

Sam and Ivan Talk about:

Sam and Ivan Talk about: